Cryptocurrency has revolution of the financial world, offering unprecedented opportunities for investment and growth. However, with the rise of this digital asset, there has also been an increase in scams targeting unsuspecting investors.

Learn how to identify and avoid these scams is crucial for anyone involved in the cryptocurrency market. This guide will provide you with essential tips and strategies to safeguard your investments.

Know About Cryptocurrency Scams

Cryptocurrency scams are fraudulent schemes designed to deceive investors by promising high returns or offering false information about digital currencies. These scams exploit the lack of regulation and the anonymity that cryptocurrencies provide, making it difficult to track and recover lost funds.

People use cryptocurrency for various reasons. They appreciate the quick of transactions, enjoy avoiding the fees that traditional banks impose, and value the level of anonymity it provides. Cryptocurrency as a promising investment, holding onto it with the hope that its value will increase over time.

You can purchase any crypto coin using crypto exchange, Wazirx app, Binance or any official website, or even a cryptocurrency ATM. Some people earn cryptocurrency by “mining,” a complex process that involves using advanced computer equipment to solve highly intricate math puzzles.

Common Types of Cryptocurrency Scams

Ponzi Schemes

Ponzi schemes in cryptocurrency involve promising high returns to investors with the funds from new investors. These schemes collapse when there are not enough new investors to pay the earlier ones.

Fake Exchanges

Fake cryptocurrency exchanges mimic legitimate ones to trick users into depositing their funds. These platforms often disappear with the money once they have accumulated a significant amount.

Phishing Scams

Phishing scams involve fraudsters impersonating legitimate companies to steal personal information or login credentials. They typically use emails or fake websites to deceive their targets.

Pump and Dump Schemes

Pump and dump schemes involve artificially inflating the price of a cryptocurrency through misleading statements and then selling off the holdings at the peak price, leaving other investors with worthless coins.

Initial Coin Offering (ICO) Scams

ICO scams occur when fraudsters create fake ICOs to raise funds for non-existent projects. Investors are lured in with the promise of high returns, only to find out that the project was a sham.

How to Identify Cryptocurrency Scams

Legitimate businesses and government agencies will never email, text, or message you on social media asking for money. They also won’t demand payment in cryptocurrency. Always avoid clicking on links in unexpected texts, emails, or social media messages, even if they appear to be from a company you know.

Identifying crypto currency scams requires vigilance and a keen eye for red flags. Here are some common indicators of scams:

| Red Flag | Description |

|---|---|

| Unrealistic Promises | Promises of guaranteed high returns with little or no risk. |

| Lack of Transparency | Vague details about the project, team, or technology. |

| Pressure Tactics | Urgency or pressure to invest quickly without adequate time to research. |

| Unsolicited Offers | Receiving unsolicited messages or emails promoting an investment opportunity. |

| Poor Website Security | Insecure websites (e.g., HTTP instead of HTTPS) or poorly designed sites. |

| Absence of Official Documentation | Lack of whitepapers, roadmaps, or legal documentation. |

Best Practices to Avoid Cryptocurrency Scams

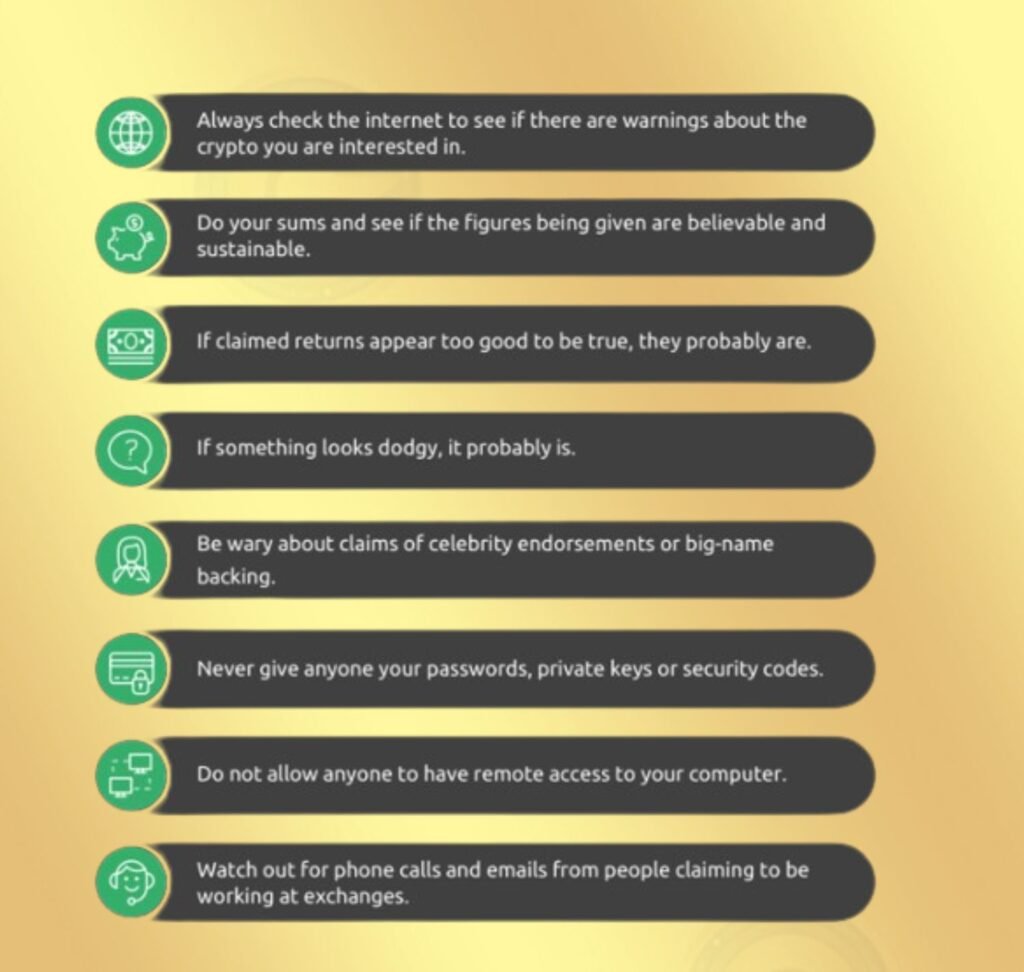

Following best practices can significantly reduce the risk of falling victim to cryptocurrency scams. Here are some essential tips:

- Do Your Research

- Thoroughly investigate any cryptocurrency or platform before investing. Look for credible sources of information and verify the legitimacy of the team behind the project.

- Use Reputable Exchanges

- Stick to well-known and established cryptocurrency exchanges. Check reviews and regulatory status to ensure the platform is trustworthy.

- Enable Two-Factor Authentication (2FA)

- Secure your accounts with two-factor authentication. This adds an extra layer of security, making it harder for scammers to access your funds.

- Be Skeptical of Unrealistic Returns

- If something sounds too good to be true, it probably is. Be wary of investment opportunities that promise high returns with little risk.

- Verify URLs and Sources

- Always double-check URLs and ensure you are on the legitimate website of the exchange or service. Avoid clicking on links from unsolicited messages.

- Stay Informed

- Keep up with the latest news and trends in the cryptocurrency space. Scammers often exploit new and emerging trends to deceive investors.

What to Do If You’ve Been Scammed

If you suspect that you’ve been scammed, it’s crucial to act quickly. Here are the steps you should take:

- Report the Scam

- Contact the exchange or platform where the scam occurred. Report the incident to relevant authorities and online scam reporting websites.

- Document Everything

- Keep detailed records of all communications, transactions, and relevant information. This documentation will be useful for any investigations.

- Inform Your Bank

- If you have linked your bank account or credit card to the scam, inform your bank immediately. They may be able to stop transactions or recover some funds.

- Alert the Community

- Share your experience with the cryptocurrency community to warn others and help prevent further scams.

- Stop contact with the scammers

- Check your Computers or Phone

- Change your account password or Crypto Wallet pin

- If you’ve been scammed and lost money or property, or if your identity has been compromised, please report it to your local police department or sheriff’s office. Your report can help take action against the scammers.

- If you discover that someone is using your personal information to open new accounts, make purchases, or claim a tax refund, head over to www.identitytheft.gov to report it. This federal government website will guide you in creating an Identity Theft Report and developing a personalized recovery plan tailored to your situation. If you have any questions, you can call 877-ID THEFT for assistance.

| Step | Action |

|---|---|

| Report the Scam | Contact exchange/platform, report to authorities. |

| Document Everything | Keep records of communications, transactions, etc. |

| Inform Your Bank | Notify your bank about the scam. |

| Alert the Community | Share your experience to warn others. |

Conclusion

In the ever evolving world of cryptocurrency, staying vigilant and informed is your best defense against scams. By understanding the common types of scams, learning how to identify them, and following best practices, you can protect your investments and navigate the cryptocurrency market with confidence. Remember, the promise of high returns often comes with high risks. Always conduct thorough research and exercise caution before making any investment decisions.

Great article! I appreciate the clear and insightful perspective you’ve shared. It’s fascinating to see how this topic is developing. For those interested in diving deeper, I found an excellent resource that expands on these ideas: check it out here. Looking forward to hearing others’ thoughts and continuing the discussion!

This was a fascinating piece. The author’s insights were very compelling. I’m eager to hear different viewpoints on this topic. What are your thoughts?

First of all, we thank you from our team. Just stay connected with us as we have created a guide to provide information on crypto and forex-related matters, which will help people.